High-Income Real Estate Investing: Methods for Making Best Use Of Returns

High-income real estate investing is a approach that focuses on properties and investments that produce considerable cash flow and solid long-term returns. Whether you're a skilled capitalist or brand-new to the property market, comprehending the subtleties of high-income property can aid you optimize your incomes and build substantial wide range. This write-up explores key strategies, types of homes, and pointers for efficiently browsing the high-income property market.

What is High-Income Property Spending?

High-income realty investing involves buying and managing properties that produce higher-than-average rental revenue or resources admiration. These buildings can vary from multi-family apartment to industrial real estate, high-end rentals, and temporary trip residential properties. The goal is to generate substantial month-to-month cash flow while also gaining from residential property recognition in time.

Trick Methods for High-Income Real Estate Spending

1. Concentrate On High-Yield Rental Qualities:

One of one of the most efficient ways to attain high earnings from property is to purchase rental properties that use high yields. This normally includes multi-family buildings, apartment buildings, and pupil housing in high-demand locations. By obtaining buildings in places with solid rental demand, you can make certain a stable stream of revenue and higher returns on your financial investment.

2. Invest in Business Realty:

Industrial realty, including office complex, retail rooms, and industrial residential properties, frequently supplies higher earnings capacity than properties. These investments include longer lease terms, which can cause a lot more secure and predictable earnings streams. In addition, commercial renters are normally responsible for home expenses such as maintenance, tax obligations, and insurance policy, reducing your general expenses and raising net income.

3. Explore Short-Term Getaway Leasings:

Temporary trip rentals, especially in prominent traveler locations, can use extremely high returns. Systems like Airbnb and VRBO have made it simpler to manage and market these properties, enabling financiers to make best use of tenancy prices and rental revenue. While temporary services call for even more hands-on monitoring, the possibility for high every night prices and boosted profits can make them a financially rewarding alternative for high-income investor.

4. Think About High-end Realty:

Luxury residential or commercial properties, whether in urban centers or exclusive getaway, satisfy high-net-worth people and can produce significant rental income. These properties usually regulate costs rental rates, especially in preferable places with high demand. Investing in deluxe realty requires a significant ahead of time investment, but the possible returns can be considerable, especially when managed effectively.

5. Utilize Value-Add Strategies:

Value-add investing entails buying buildings that call for enhancements or renovations to increase their value and rental earnings capacity. By upgrading systems, boosting features, or improving building administration, investors can significantly boost the residential property's market value and rental revenue. This technique is particularly reliable in high-demand areas where restored residential or commercial properties can regulate higher leas and bring in preferred occupants.

Types of High-Income Realty Investments

1. Multi-Family Properties:

Multi-family homes, such as duplexes, triplexes, and apartment building, are popular among high-income capitalists due to their capacity for consistent capital and scalability. With multiple systems, these buildings provide diversified income streams, decreasing the threat related to tenant jobs.

2. Green Springs Capital Group Commercial Realty:

As pointed out previously, business real estate investments can produce higher returns because of longer rent terms and greater rental prices. Office, retail facilities, and industrial residential or commercial properties are common kinds of industrial property that interest high-income capitalists.

3. Short-Term Rentals:

Temporary services in high-demand areas, like beachfront properties or urban centers, use the capacity for high earnings with nighttime or regular rates. These homes take advantage of high tenancy rates throughout optimal traveling periods, causing considerable income generation.

4. REITs (Real Estate Investment Trusts):.

For those looking to invest in high-income property without straight having homes, REITs offer a way to buy income-producing property possessions. REITs provide the advantage of liquidity, as they are traded on significant stock market, and they disperse a substantial part of their income to investors in the form of rewards.

5. Industrial Properties:.

The increase of ecommerce has driven demand for commercial residential properties, including warehouses, warehouse, and satisfaction hubs. These buildings are commonly leased High-income real estate investing to huge companies under long-term arrangements, providing steady and high rental income.

Tips for Effective High-Income Real Estate Spending.

1. Conduct Thorough Market Research:.

Recognizing the local property market is important for identifying high-income chances. Analyze rental need, vacancy prices, and building values in potential financial investment areas. Focus on areas with strong financial growth, task possibilities, and population rises, as these factors drive need for both domestic and commercial buildings.

2. Take Advantage Of Financing Tactically:.

Using take advantage of effectively can enhance your returns on high-income property investments. However, it's important to make certain that your rental income can cover home loan settlements and other expenditures, leaving area for profit. Deal with monetary experts and home mortgage brokers to secure desirable funding terms that support your financial investment technique.

3. Expand Your Profile:.

Diversifying your real estate profile across various residential or commercial property types and locations can help reduce danger and improve general returns. By purchasing a mix of household, business, and short-term rental properties, you can produce a balanced portfolio that carries out well in different market conditions.

4. Focus on Renter High Quality:.

Renter quality directly impacts the income potential of your rental homes. Display lessees extensively to guarantee they have a solid rental background, steady earnings, and good credit report. Top notch occupants are most likely to pay rent on time, take care of the property, and remain long-lasting, minimizing turnover costs and openings prices.

5. Remain Informed on Market Trends:.

The real estate market is frequently advancing, with patterns in technology, demographics, and financial factors influencing need and residential property values. Stay educated regarding these trends to determine arising opportunities and adjust your financial investment technique as necessary.

High-income realty investing offers a path to considerable wide range build-up and financial freedom. By focusing on high-yield rental properties, industrial real estate, temporary vacation leasings, and value-add opportunities, capitalists can generate considerable income and long-lasting appreciation. Success in this area requires complete market research, calculated funding, portfolio diversity, and a https://greenspringscapitalgroup.com/ focus on occupant quality. Whether you're just starting or looking to broaden your existing profile, high-income realty investing can be a effective tool for developing a flourishing financial future.

Christina Ricci Then & Now!

Christina Ricci Then & Now! Destiny’s Child Then & Now!

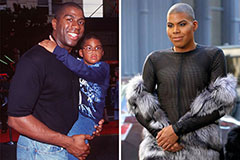

Destiny’s Child Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!